FREQUENTLY ASKED QUESTIONS

Are Montana’s pension plans falling apart?

Short answer: no.

In the years after the Great Recession of 2008, Montana’s retirement systems faced structural funding problems. At that time, a broad coalition came together to find a solution.

In 2013, the legislature passed bills to stabilize the pension systems, which included shared sacrifices by both employees and employers. New provisions were added, including increased employer and employee contributions for members and changes in benefits for new hires.

Pensions work on a long timeframe and changes take time to start having an impact. The actuarial reports issued annually by the boards of MPERA and TRS show that things are gradually and steadily improving. There is no reason to suspect that this won’t continue, as a result of changes enacted in 2013.

But I keep hearing that the sky is falling and pensions are in debt.

Think of a pension like a college savings account. You start when your child is born: initially, there isn’t much money in it. That’s fine, because you aren’t sending your kid off to college tomorrow! But if you know you will need $80,000 saved at the end of 18 years, you can plan how much to put in each month.

Part of your plan to reach $80,000 by the time your child turns 18 involves earning 3% interest on your savings. However, imagine that as your kid hits middle school, the economy hits a rough patch and your actual interest earnings are only 1.5%. All of a sudden, the amount you are putting in each month won’t get you to the magic number of $80,000 in time. This is an “unfunded liability” – it is unexpected “debt” that develops because the world doesn’t remain static. It fluctuates over time. For instance, if the market went the other way during your child’s sophomore year, you could get 5% interest – and suddenly you would reach $80,000 before your child’s 18th birthday, wiping out ANY unfunded liability!

The unfunded liability is what is often perceived as the big, bad wolf when people propose that pension systems are falling apart. However, these small economic variations are relatively minor compared to the overall balance in the system and shouldn’t be viewed as a mark of a broken pension plan.

Are Montana's public pensions a drain on taxpayers?

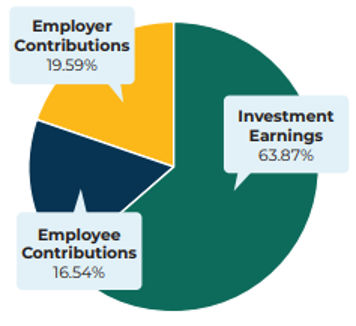

Evidence tells us they are not. The National Institute on Retirement Security (NIRS) has published a report entitled Pensionomics 2021: Measuring the Economic Impact of DB Pension Expenditures, along with a fact sheet for each state. In the Montana fact sheet (pdf), NIRS estimates that “each taxpayer dollar ‘invested’ by Montana taxpayers in these pension plans supported $6.16 in total economic activity in the state.” Furthermore, NIRS points out that earnings on investments and employee contributions – not taxpayer-based contributions – have historically made up the bulk of pension fund revenue.

How do public pension dollars help the economy?

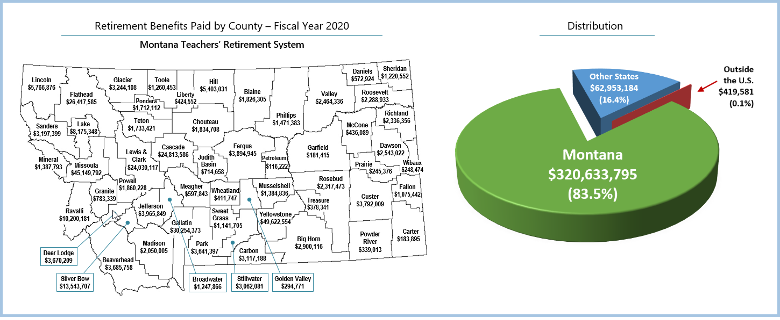

As noted in the NIRS Pensionomics 2021 Montana fact sheet, “Each dollar paid out supports $1.21 in total economic activity in Montana.” The bulk of money paid out to retirees stays right here in Montana – 80-90%, in fact. Pension systems help support our retirees as they stay in Montana, spending hundreds of millions in their local communities. Each dollar they spend on goods and services has a multiplier effect on your local economy.

Learn more about how pensions benefits support Montana’s economy:

Are Defined Contribution (DC) plans better and cheaper than Defined Benefit (DB) Plans?

Overall, DB plans (aka pensions) cost significantly less to implement than Defined Contribution Plans (aka 401(k), 403(b), or retirement savings accounts), and the cost difference is three-fold:

- Because DB plans pool the longevity risks of large numbers of individuals, they need only accumulate enough funds to provide benefits for the average life expectancy of the group.

- DB plans are able to take advantage of the enhanced investment returns that come from a balanced portfolio over long periods of time.

- DB plans achieve greater investment returns than DC plans.

(NRTA Pension Education Toolkit, NIRS)

Converting to a DC plan would effectively “close the system” therefore forcing the state to pay off the unfunded liability. Not long ago, there was interest in moving the Montana State Fund (which oversees Worker’s Compensation) out of the pension system.

The estimated cost to the state? An eye-popping $97 MILLION dollars.

Montana State Fund only has about 300 workers; imagine the cost to force the state’s other 50,000 public employees off their pension plans and into a risky, uncertain future on a DC plan.

Interested in learning more about Defined Benefit Pensions?